Articles | December 12, 2025

This multiemployer pension plan news recap covers:

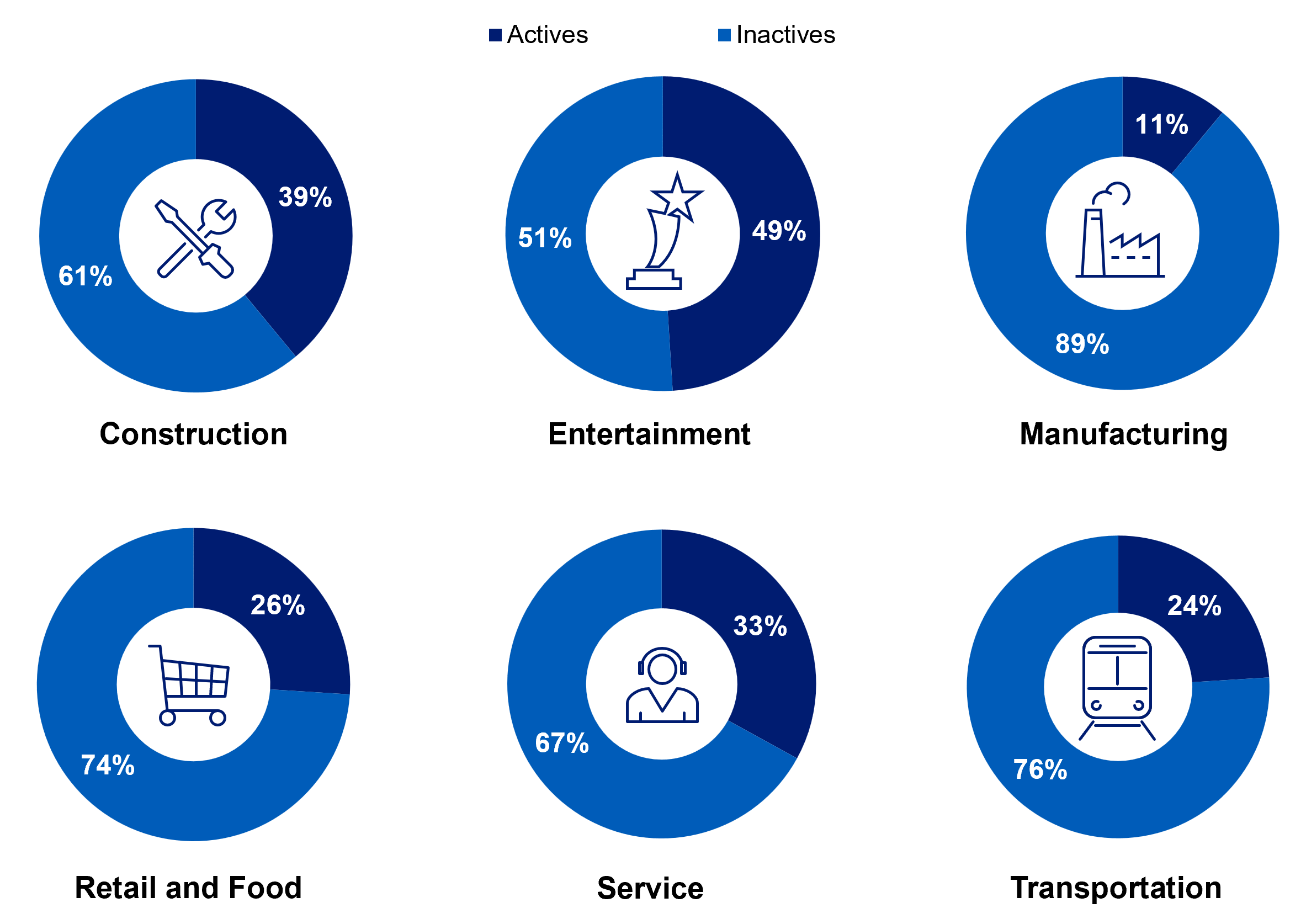

One measure of retirement plan maturity is the ratio of inactive to active participants. As this ratio increases, there is greater risk associated with market fluctuations and plan experience. If adverse experience occurs, mature plans are less able to improve their funding levels with corrective measures such as contribution rate increases or future accrual rate reductions.

Source: Segal’s Fall 2025 Survey of Plans’ Zone Status

Since 1976, there have been 20 federal government shutdowns lasting at least a day. In most cases, either while they were occurring or within three to six months after they ended, the stock market increased. While government shutdowns can cause temporary hardship, investors instead tend to focus on corporate earnings, economic growth and interest rate moves.

The U.S. federal government shutdown that began on October 1 and ended on November 12 was not an exception to this pattern. While the shutdown was highly disruptive to a wide range of federal government services, it did not rattle stock investors much. The S&P 500 Index® rose 2.6 percent in October, buoyed by solid earnings reports from technology, financial and healthcare companies. The government shutdown also did not affect the government’s creditworthiness because of its continued ability to pay its debts.

The Federal Reserve (the Fed) cut short-term interest rates in September, October and December 2025, the Fed’s first rate reductions since December 2024. Fed Chair Jerome Powell cited a weakening job market for the Fed’s decision to cut rates. The U.S. unemployment rate has ticked up to 4.4 percent as of September 2025, with several large firms, including Amazon and Target, recently announcing layoffs. Although the Bureau of Labor Statistics has not published unemployment data since September, the Chicago Fed estimated that unemployment in October and November held relatively steady at around 4.4 percent.

Even though interest rate reductions may keep the unemployment rate from rising significantly in the near term, the rate cuts may also lead to a different problem: higher inflation. The Consumer Price Index (CPI) rose 0.3 percent in September and 3.0 percent over the previous 12 months. Given the persistence of inflation, another rate cut in December is uncertain, even with the weaker labor market.

Plan participants are often unaware of or confused about their benefits. A major reason is that benefits communications tend to take a one-size-fits-all approach, overlooking the diverse and evolving needs of participants at different stages of their lives. Plan sponsors have an opportunity to better tailor their benefits communications to different participants by adopting a strategic approach. Four tips for more effective benefits communications are:

With the goal of increasing participation and enhancing participant satisfaction in their benefits programs, learn more about effective communications here and reach out to your Segal consultant.

The SECURE 2.0 Act increased the automatic cash-out threshold for defined benefit and defined contribution plans from $5,000 to $7,000, effective for distributions made after December 31, 2023, if adopted. (See our January 4, 2023 insight.)

If expanded to terminated vested participants as well as to participants upon retirement, plan sponsors could potentially cash out more participants with this higher threshold. By cashing out these participants, the plan would reduce their annual PBGC premiums and reduce the plan’s overall risks by lowering its liabilities and ease other administrative burdens. However, the costs and savings of cashing out participants will vary for each plan, depending on factors such as participant demographics, current market interest rates and the plan’s actuarial assumptions. Trustees who are interested in exploring an expansion of their small benefit cash-out rules can learn more in our August 18, 2025 article and reach out to their actuary to help them make an informed decision.

The IRS announced the 2026 dollar limits for qualified retirement plans and other tax-favored plans in late 2025. Plan sponsors should be aware of plan limits changing in 2025. New maximums, limits and thresholds will need to be updated in software programs or spreadsheets, as needed. To compare the new figures to the 2025 figures, check out our November 14, 2025 insight.

Also, for plan years beginning in 2026, the PBGC's flat-rate, per-participant premium for multiemployer plans will increase from $39 to $40.

Speak to your Segal consultant or

Contact UsThe “Investment Trends” section of Currents was prepared using investment information from public and private sources that Segal Marco Advisors believes to be reliable. No representation or warranty stated or implied is given as to the accuracy of the information contained herein. The publication is distributed for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with your own financial, legal or other advisor for the purpose of assessing whether the ideas or strategies are suitable to you. The information contained herein, is not and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Segal and Segal Marco Advisors expressly disclaim any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.

Contact Segal Marco Advisors for advice regarding the evaluation of any “Investment Trends” content. Segal Marco Advisors posts new content regularly to the Investment Insights page.

Retirement, Compliance, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, Corporate

Retirement, Compliance, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, Corporate

Retirement, Multiemployer Plans

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

Don't miss out. Join 16,000 others who already get the latest insights from Segal.

© 2026 by The Segal Group, Inc.Terms & Conditions Privacy Policy Style Guide California Residents Sitemap Disclosure of Compensation Required Notices