Archived Insight | March 10, 2022

Get the health plan news you need for Q1 2022.

Our latest short quarterly roundup of healthcare news for plan sponsors covers:

Get the details below.

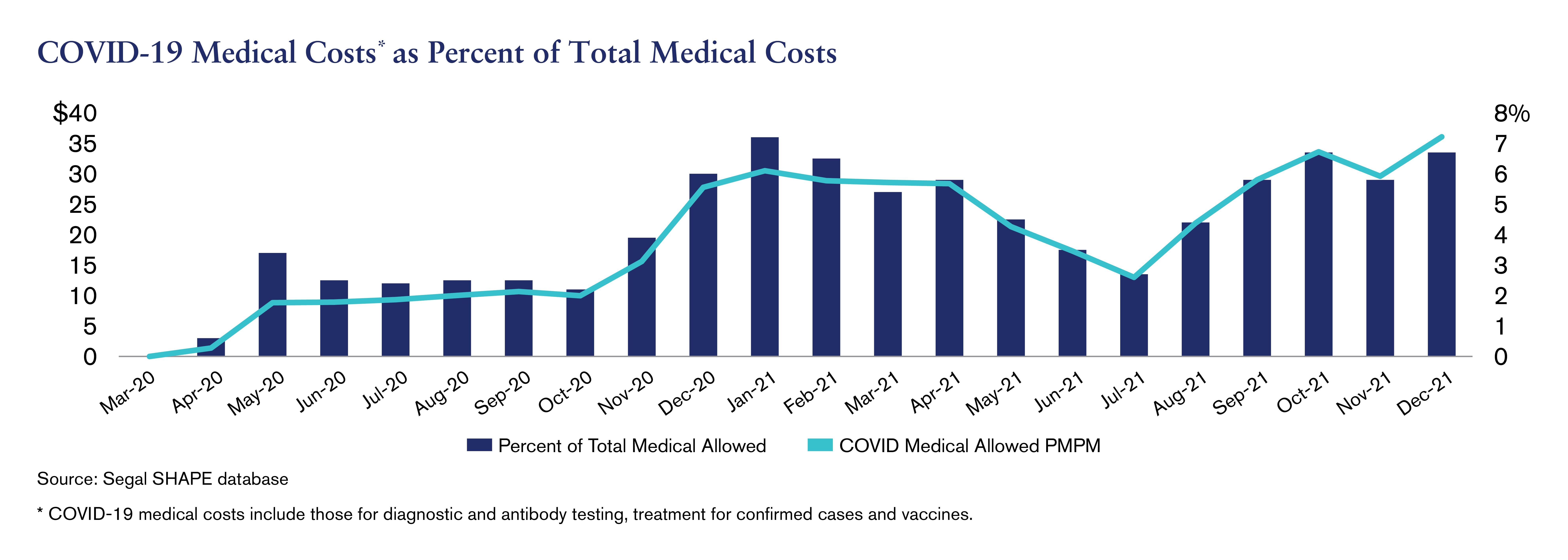

Between March 2020 and December 2021, COVID-19 medical costs accounted for 4.5 percent of total medical costs, according to our data. In December 2021, COVID-19-related per-participant medical spending averaged $36.07.

Pre-pandemic, telehealth was almost nonexistent. At the beginning of the pandemic, telemedicine became popular because it was the safest way to access care. Additionally, policy changes enabled wider coverage of and access to telehealth.

The most notable benefit of telehealth is that it improves access to care. Telemedicine has the potential to reduce health disparities because it enhances access to providers and reaches vulnerable populations, like elderly, low-income and rural populations that lack access to high-quality, in-person care.

| Other Benefits of Telehealth |

|

Advances convenience and efficiency by:

|

| Provides faster access to care because there are more provider options, so appointment openings are easier to find |

| Improves cost-effectiveness of care by helping to avoid unnecessary ER or hospital visits |

|

Improves health outcomes by:

|

Studies show that virtual care can be as effective as in-person care. During the pandemic, behavioral healthcare accounted for majority of telehealth visits, but telemedicine is a good platform for many other types of care, including:

Despite these benefits, there are barriers to, limitations of and concerns about virtual care. Although telehealth expands access to care in many ways, lack of access to broadband prohibits patients’ ability to use telemedicine. About 25 percent of adults in the U.S. do not have access to broadband. Populations most likely to lack access to both the internet and devices that provide ability to access video calls are groups that already experience lower quality of and access to care, like low-income, people of color and rural populations. If these issues are not addressed, virtual care has the potential to worsen, rather than improve, health inequities.

| Barriers to, Limitations of and Concerns About Telehealth |

|

Lack of digital literacy:

|

| Not all care (e.g., physical exams and diagnostic testing) can be conducted virtually |

| Telehealth coverage policies may restrict access (e.g., providers with license in one state may no longer be able to provide care to patients in another state), types of services covered by telehealth may decrease and provider reimbursement/payment may decrease |

| Rules concerning payment for telehealth under HSA-qualified High-Deductible Health Plans are uncertain until Congress or the IRS provides further guidance |

The health benefits of telemedicine outweigh these technical and policy issues. Plans can work with their insurers to implement policies and benefits that increase telehealth coverage and use.

Plans can permanently cover telehealth services and allow all providers, of any specialty and from any state, to provide virtual care to participants. Provider licensing practices were lenient during the pandemic, but many states are reverting to more restrictive policies that reduce access to care for participants. Plans should also consider permanently covering audio-only visits. Although there are concerns about quality of care, audio-only visits are better than no care at all.

Plans need to educate participants on how and when to use telehealth benefits. Plans should focus on educating vulnerable populations that could benefit from telemedicine.

On February 4, the Departments of Health and Human Services, Labor and Treasury released guidance on COVID-19 over-the-counter tests, which group health plans are required to cover. The guidance established a safe harbor, with several requirements, for direct coverage programs. Plans should also inform and educate participants about coverage options.

See our February 8 insight for details about the guidance.

A recent U.S. Supreme Court decision concluded that COVID-19 vaccinations may be required for all healthcare workers; however, the Supreme Court did not permit the Occupational Safety and Health Administration (OSHA) to mandate COVID-19 vaccination and weekly testing requirements for employers with more than 100 employees. Subsequently, OSHA pulled the rule for large employers.

Learn more about this decision.

To discuss the implications for your plan of

anything covered here, contact your Segal consultant or get in touch.

Health, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, Corporate, Healthcare Cost Management

Pharmaceutical, Health, Benefits Administration, Benefit Audit Solutions

Compliance, Health, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, Corporate, Pharmaceutical

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

Don't miss out. Join 16,000 others who already get the latest insights from Segal.

© 2026 by The Segal Group, Inc.Terms & Conditions Privacy Policy Style Guide California Residents Sitemap Disclosure of Compensation Required Notices