Archived Insight | January 27, 2022

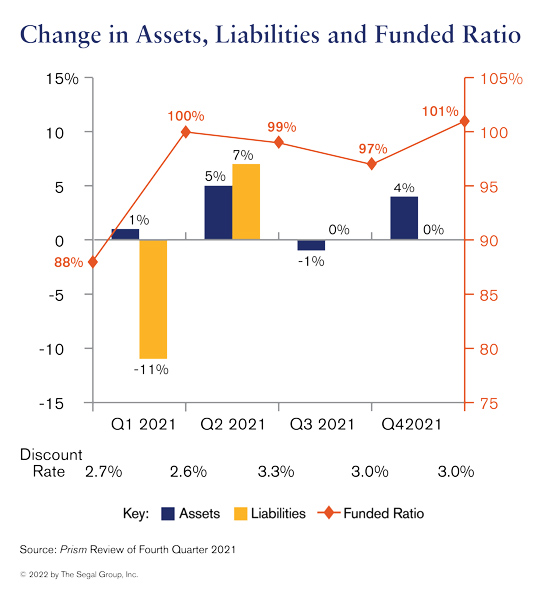

During the fourth quarter of 2021, the funded status of the model pension plan examined in each issue of Prism rose by 4 percentage points, to 101 percent, as illustrated in the graph below.

This increase in funded status is primarily attributable to a 4 percent increase in assets.

U.S. equity markets performed very well during the fourth quarter, to close out a third consecutive calendar year of above-20 percent returns. Developed international equities also performed well for the quarter and the year, but trailed U.S. equities for a fourth consecutive quarter.

Plan sponsors should examine changes in their own DB plans’ assets, liabilities and funded ratios from the vantage point of both accounting and funding metrics.

We can help employers project their DB plans’ funded ratios with a complete view of the range of a plan’s possible future statuses, presenting early warning signs of potential challenges.

Retirement, Investment, Multiemployer Plans, Public Sector, Consulting Innovation, Corporate

Benefits Administration, Communications, Health, Compensation & Careers, Corporate, Retirement, Organizational Effectiveness, Public Sector

Retirement, Technology, Organizational Effectiveness, Benefits Administration, Benefits Technology, Corporate, Benefit Audit Solutions

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

Don't miss out. Join 16,000 others who already get the latest insights from Segal.

© 2026 by The Segal Group, Inc.Terms & Conditions Privacy Policy Style Guide California Residents Sitemap Disclosure of Compensation Required Notices