Archived Insight | March 5, 2021

Floods are the most common natural disaster. In the U.S., they account for 90 percent of all natural disasters, according to the National Flood Insurance Program (NFIP).

Significant flooding can happen anywhere. The Federal Emergency Management Agency (FEMA) has statistics that show every state has experienced floods.

While most flood insurance claims come from what the NFIP calls Special Flood Hazard Areas, which have a high risk of flooding, more than 40 percent of claims in recent years have come from areas that have a moderate-to-low risk of flooding.

This article discusses flood risk and how to assess whether your organization has coverage in place to provide protection if your property is damaged in a flood. Typically, property and casualty insurance may not adequately protect against flood damage. To protect your organization in the event of a flood, you may need flood insurance.

Hurricanes and tropical storms can lead to coastal flooding. There were 30 named hurricanes in 2020, a record high.

Other sources of flooding include heavy rains, which can trigger flash flooding and levee or dam breaks, and spring thaw from melting snow. There’s a higher risk of flash flooding and mudflows in the aftermath of wildfires.

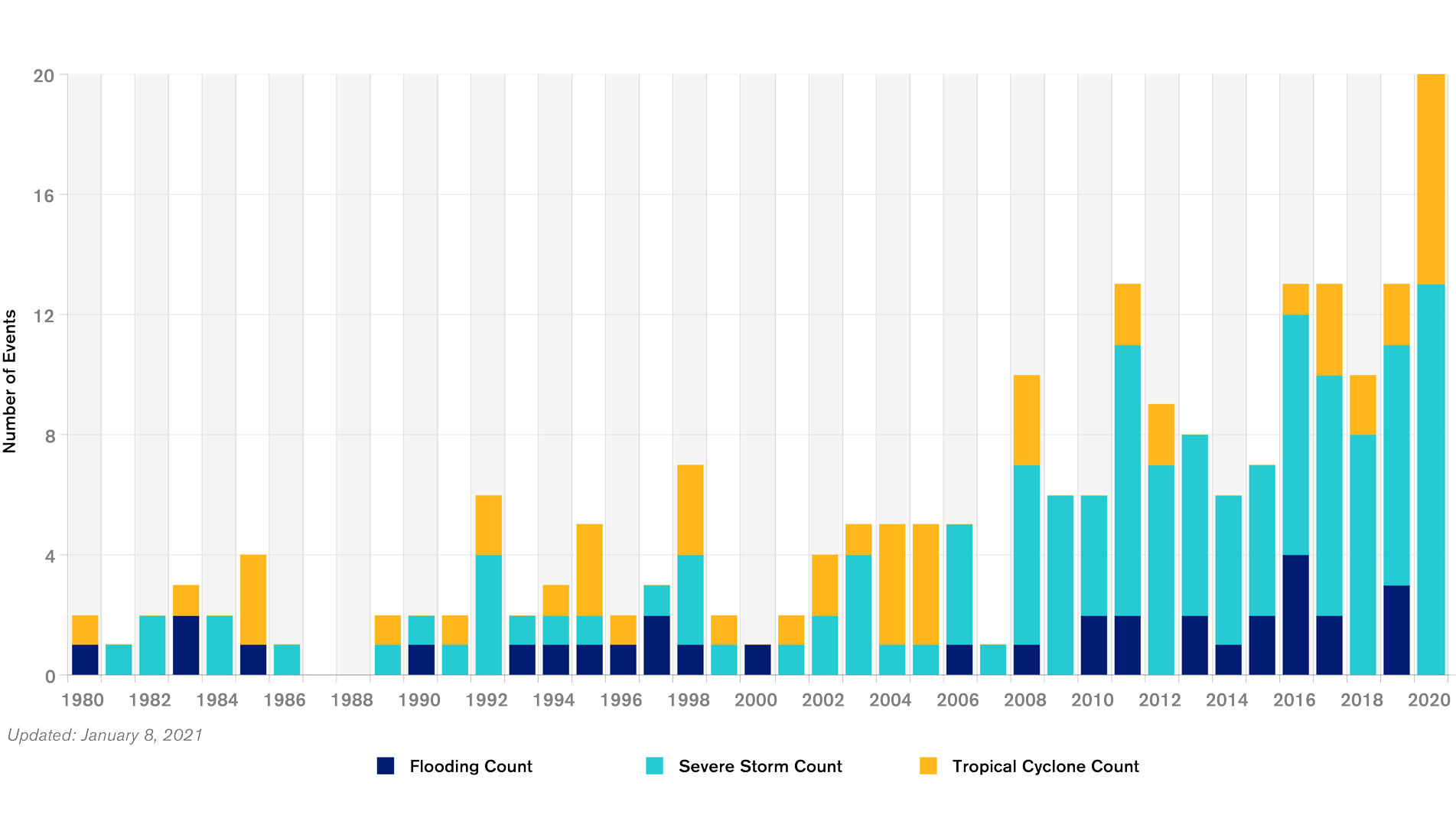

From 1980 to today, the numbers of severe floods and other weather-related events associated with flooding, such as hurricanes, have been increasing.

Source: National Oceanic and Atmospheric Administration, National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2020). https://www.ncdc.noaa.gov/billions/time-series, DOI: 10.25921/stkw-7w73

A flood doesn’t have to be severe to have a major impact. Just a few inches of floodwater can cause tens of thousands of dollars in damage, according to FEMA.

Total insured losses from all 2020 hurricanes were nearly $22 billion, according to estimates by Karen Clark & Company. For the most damaging storm of the season, insured losses were $9 billion.

Scientists at Colorado State University’s Department of Atmospheric Science have predicted the probability of a hurricane or major hurricane impacting states on the East and Gulf Coasts. The chart below shows those predictions.

| State | Hurricane | Major Hurricane |

| Florida | 51% | 21% |

| Texas | 33% | 12% |

| Louisiana | 30% | 12% |

| North Carolina | 38% | 8% |

| South Carolina | 17% | 4% |

| Alabama | 16% | 3% |

| Mississippi | 11% | 4% |

| Georgia | 11% | 1% |

| New York | 8% | 3% |

| Connecticut | 7% | 2% |

| Massachusetts | 7% | 2% |

| Rhode Island | 6% | 3% |

| Virginia | 6% | 1% |

| Maine | 4% | <1% |

| Maryland | 1% | <1% |

| Delaware | 1% | <1% |

| New Jersey | 1% | <1% |

| New Hampshire | 1% | <1% |

Source: Philip J. Klotzbach, Michael M. Bell and Jhordanne Jones, “Qualitative Discussion of Atlantic Basin Seasonal Hurricane Activity for 2021.” Department of Atmospheric Science, Colorado State University (December 10, 2020). Reprinted with permission.

The National Oceanic and Atmospheric Administration is expected to issue its 2021 flood forecast in April.

It’s a good idea to review your commercial insurance coverages to verify if you are adequately protected in the event of a flood.

Commercial insurance coverages do not always include flood protection. Even if they do, in geographic areas that have a high flood risk, it may be prudent to purchase a stand-alone flood policy. If you have a mortgage, the lender can require flood insurance depending on your flood zone.

Segal offers a complimentary policy review to assess the appropriateness of your current property and casualty coverage and flood coverage.

As part of our review we will:

If you already have flood coverage, among the possible changes we may discuss with you is the option to choose different deductibles for building and contents coverage that apply separately to building and contents claims. If you are prepared to cover more of the out-of-pocket cost to rebuild in the event of a claim, another option is to choose a higher deductible to lower your premium.

As a leading broker for plan sponsors for decades, we have the experience to give you insights into coverage gaps and options for closing them.

Ask us to review your commercial insurance coverages.

Speak to Our P&C Professional

Multiemployer Plans, Technology, Benefits Technology, ATC

Retirement, Multiemployer Plans

Health, Compliance, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, Corporate

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

© 2024 by The Segal Group, Inc.Terms & Conditions Privacy Policy California Residents Sitemap Disclosure of Compensation Required Notices

We use cookies to collect information about how you use segalco.com.

We use this information to make the website work as well as possible and improve our offering to you.