Articles | July 27, 2022

This Q3 2022 multiemployer pension plan news recap covers:

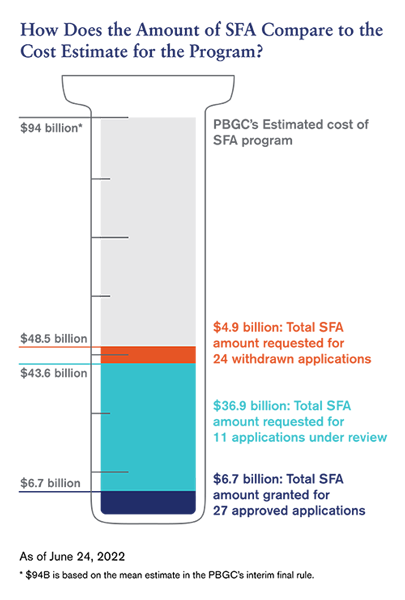

Applications for special financial assistance (SFA) account for just over half of the PBGC's estimated cost of the SFA program. The graphic below shows the breakdown by applications that are under review, withdrawn and approved.

Countries, companies and organizations around the world are pledging to reach net-zero carbon emissions by 2050. This push for decarbonization will create investment opportunities in infrastructure. Increased focus by governments is fueling rapid investment in green energy and energy transition. It will require significant capital investment both in existing infrastructure as well as in development of new plants and technologies.

The move towards net-zero carbon emissions has also broadened the opportunity set for infrastructure investors. Key areas of opportunity include the production of different forms of renewable and low-carbon energy as well as the infrastructure and technologies required to support their penetration, adoption and efficiency. While estimates vary, the global investment required to reach net-zero CO2 emissions by 2050 ranges between $4.5 trillion and $5.8 trillion annually. For a more detailed discussion of infrastructure and net zero, see Segal Marco Advisors’ December 2021 article.

Tyranny is defined as “an act or pattern of harsh, cruel and unfair control over other people.” At times, the investment industry may take advantage of investor behaviors to almost tyrannically influence investors into decisions not in their best interest.

Such behaviors include “anchoring,” where an exposure to an initial number influences judgment. An investor may be “anchored” to feel like oil prices are through the roof. However, the incredible volatility (including downward swings) of oil prices over time tells a far different story.

Another example is herding bias, which is the tendency to follow the crowd without sufficient rationale. During short-term market swings, herding bias leads investors to sell to avoid disaster or to buy to find the “next big thing,” even though a long-term outlook and diversified portfolio are almost always better options.

To fight the tyranny of behaviorism, investors can be aware of these biases, do independent homework to gain a deeper understanding of markets, think about why certain information may be inaccurate, and consider what period was used to display data. Read more about behaviorism in Segal Marco Advisors’ January 2022 article.

A recent study from the National Institute on Retirement Security (NIRS) compares a typical large public sector DB plan to a DC plan with industry average fees and expected investment returns based on typical individual investor behavior. Although this study is based on a public sector plan, the findings are of interest to multiemployer plans. It shows that the DB pension plan provides a given level of retirement benefit at about half the cost of a DC plan, because of three factors:

A shift from a DB pension plan to a DC plan offers a way to transfer investment risk borne by employers to participants, but this comes with either increased benefit costs or significant retirement benefit cuts that are larger than the savings realized by the employer. Hybrid retirement plans that combine some of the features of DB and DC plans remain more cost effective to the extent that hybrid benefits emphasize DB-like characteristics. For more details on this study, read the NIRS report, “A Better Bang for the Buck 3.0.”

For over a decade, participants of DC plans that are given investment choices have legally challenged those investment options and/or fees. These lawsuits have been extremely costly to 403(b) plans. On January 24, 2022, the Supreme Court ruled that DC plans cannot include non-prudent investments, making it a fiduciary’s duty to monitor all investment options. This prudence standard applies to both 403(b) and 401(k) plans. Because this decision has implications for similar current lawsuits and potential future cases brought by participants in a DC plan with investment options, it is recommended that sponsors of 403(b) and 401(k) plans consult with their attorneys on how best to address their current investment options. The Supreme Court’s decision in Hughes v. Northwestern reasoned that plan fiduciaries are required to conduct their own evaluation to determine which investment options can prudently be included in a plan’s menu of options. Failing to remove a non-prudent investment option from a DC plan is a breach of fiduciary duty.

Learn more about this U.S. Supreme Court decision in our January 2022 insight.

Contact your Segal consultant or

Contact Us

Retirement, Investment, Multiemployer Plans

Retirement, Compliance, Multiemployer Plans, Architecture Engineering & Construction, Corporate, Healthcare Industry, Higher Education

Compliance, Retirement, Multiemployer Plans, Healthcare Industry, Corporate, Architecture Engineering & Construction

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

© 2024 by The Segal Group, Inc.Terms & Conditions Privacy Policy California Residents Sitemap Disclosure of Compensation Required Notices

We use cookies to collect information about how you use segalco.com.

We use this information to make the website work as well as possible and improve our offering to you.